IRS Announces Employer ACA Reporting Deadlines: 7 Questions Answered

Each year at this time I like to revisit for employers the deadlines around ACA reporting. It’s also a good time to revisit the various forms, their purpose, and most importantly, how to keep it all straight.

Read on for important information regarding the reporting deadlines and answers to some of the most frequently asked compliance questions from employers.

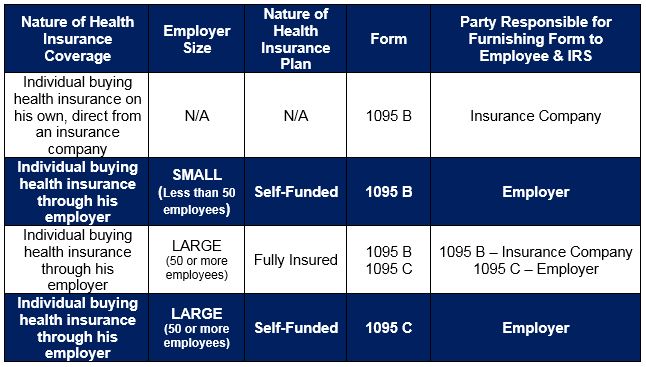

1. What is the difference between the 1095-B and 1095-C forms?

If the 1095 B and 1095 C forms continue to be a point of confusion for you remember it is essentially a W2 that reports on health insurance coverage for the prior year. Try this little trick for remembering which is which.

1095-B Forms:

- Think of the “B” as standing for “Bought health insurance”.

- This is the form that insurance companies send to individuals so those individuals can prove to the IRS they BOUGHT health insurance in the prior year.

- In many cases it will be the insurance companies furnishing the B forms to individuals and to the IRS. The only exception occurs with self-funded employers. (See the table below for explanation).

NOTE: Beginning January 1, 2019, the Trump Administration eliminated the tax penalty that previously had been charged to individuals who chose to go without health insurance. Although the requirement to carry health insurance still exists under the individual mandate, the monetary penalty for not adhering to the law has been abolished.

Because of this, insurance companies and large employers still have to fulfill their reporting requirements to show which individuals had health coverage during the previous tax year. Remember I don’t write the laws I just try and explain them…

1095-C Forms:

If it helps to remember, think of “C” in 1095-C as standing for “Compliments” of the employer.

The “C” forms are forms large employers (those employing 50 or more full time equivalents) use to prove to the IRS that they offered health insurance to all full-time employees in the prior tax year.

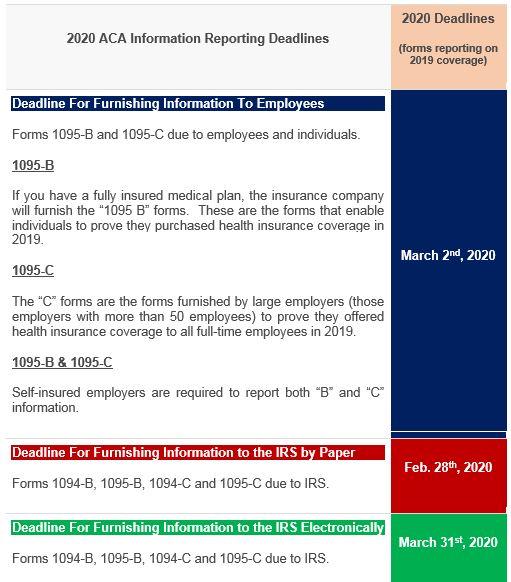

2. What are the deadlines for furnishing the forms?

3. What are the penalties for failing to file by the deadline?

- Penalty for failing to furnish forms to employees by the March 2nd, 2020 deadline: $270.00 per return

- Penalty for failing to file with the IRS by February 28th, 2020 (if filing less than 250 forms) or March 31st, 2020 if filing electronically more than 250 forms: $270.00 per return

- Failure to adhere to both deadlines will cost an employer $540.00 per return.

So in the case of 100 employees, failure on both counts could cost an employer $54,000.00.

4. What are the penalties for forms containing errors?

For 2019 forms the IRS has extended the “good-faith” relief that applied to filings in previous years. This relief applies to missing and inaccurate taxpayer identification numbers and dates of birth, as well as other information required on the return or statement.

In other words, do your best to complete the forms accurately. As long as you furnish and submit by the required deadlines the IRS is willing to overlook any errors. But remember, to show good faith efforts to qualify for this relief, filers must meet all applicable deadlines as outlined above.

5. Can an employer apply for an extension on the deadlines for filing with the IRS?

Filers can still take advantage of an automatic 30-day extension of the IRS filing deadline by submitting Form 8809 before the relevant due date. Click here to download Form 8809.

6. Can I file my returns by paper, regardless of how many I am filing?

No. Employers filing 250 or more returns are required to file electronically.

7. Can employees file their tax returns without the 1095B, 1095C forms?

Yes. In view of the fact the deadline for furnishing 1095B and 1095C forms has been extended to March 2nd, 2020 and the W2 deadline remains January 31st, 2020, many employees may be ready to file their tax returns prior to receiving their 1095B and 1095C forms.

The IRS does not penalize individuals who file their tax returns in the absence of a 1095B or 1095C form.

For questions or assistance in completing the forms, please contact me at jmorrow@employerbenefitsandadvice.com or 602-903-4047.