5 Things Employees Must Be Told About Health Insurance

Every year at open enrollment I do my best to explain to employees not just how their health insurance works, but more importantly, how to make sure it works for them when they need it to.

A recent Harvard study listed medical debt as the biggest cause of bankruptcy in America, representing 62% of all personal bankruptcies. However, perhaps most interesting is that 78% of filers had some form of health insurance.

In the spirt of the holiday season and in keeping with the growing trend toward employee financial wellness, I thought I would share 5 of my most valuable tips that I explain each year during open enrollment meetings to protect employees from becoming part of that statistic.

Note: If your employees would benefit from a similar presentation, contact me at jmorrow@employerbenefitsandadvice.com or 602 903-4047.

#1 – When Health Insurance Works Best

The hospital remains the one place where you will rack up the largest of all healthcare debt.

Without health insurance, a 3 night stay in hospital can run a person between $30,000 – $60,000 depending on where you are.

I’m always amazed when I hear friends and family go on about office visit copays or complain about how much they paid for their most recent lab work. “My policy doesn’t cover anything” someone told me recently.

Let’s remember that the primary reason we all buy health insurance in the first place is to cap a $30,000 hospital bill at something more reasonable even if it’s $5,000 or $6,000. Although this risk rarely occurs – typically 2-5% of all employees meet their total out of pocket limit in plan year. For everything else there are ALL KINDS of tips and tricks for saving on the everyday incidentals.

Remember: The number one reason you buy health insurance is to stop the bleeding if you ever go into hospital – no pun intended.

#2 – The Most Important Thing to Look for in a Health Plan

Secondly, I’ve learned over the years that the majority of people don’t understand which of their health insurance policy features references the “cap” I mention above. Most think it’s the “deductible” but that’s not the case.

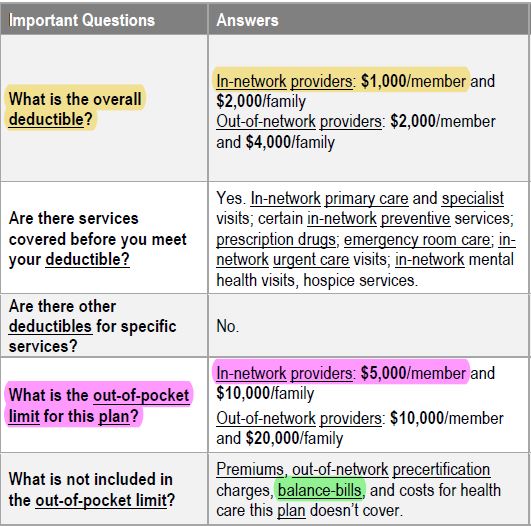

The cap is referred to by health insurers as the total “Out of Pocket” limit, which includes the deductible amount and identifies a person’s total financial responsibility on a health insurance plan.

See example of a typical plan summary below.

Deductible – highlighted in YELLOW

Total Out of Pocket limit – highlighted in PINK.

Unfortunately, in disclosing the deductible and coinsurance amount to consumers insurance companies are simply sharing the complicated math of how they arrive at the total Out of Pocket (OOP) limit which confuses people even more.

Remember: Forget about the deductible and coinsurance. The total Out of Pocket Limit is more important than your deductible, and perhaps the most important feature in a health insurance policy. Find out what yours is!

#3 – When it Makes Sense to Not Use Health Insurance

Healthcare is: the maintenance or improvement of health via the prevention, diagnosis, and treatment of disease, illness, injury, and other physical and mental impairments in people.

Health insurance is: simply a way to finance healthcare and tends to work best when used to pay for the big ticket expenditures.

Like any type of financing, sometimes it makes sense to use insurance for purchasing healthcare and sometimes it doesn’t.

Check out this example:

An MRI earlier this year was going to cost me $551.00 with my United Healthcare card, but only $224.00 if I paid cash. Needless to say I took the 50% discount. A provider cannot demand you use insurance so don’t let them bully you into using it if it doesn’t make financial sense for you to do so.

Remember: In some circumstances it makes better financial sense to pay cash and leave your health insurance card in your wallet.

Get in the habit of asking for the cash price every time you buy healthcare so you can make an informed decision for your family one way or the other.

#4 – Know the Cause of a Health Insurance Epic Fail

So what about the 78% of bankruptcies referenced at the start of this article who, despite having medical insurance, are drowning in medical debt?

Let me first explain that a physician without a contract with your insurance company is like a basketball player without a contract in the NBA – he is a free agent. He is not bound by a contract with any one insurance carrier and as such he is free to charge you whatever he wants.

- A non-contracted physician will bill your insurer for his full fee.

- The insurer will reimburse him at the rate they use to pay their contracted providers, typically much less.

- Whatever the difference is becomes your responsibility. It’s called a “balance bill”.

- For this reason, when using health insurance it’s important employees understand the importance of dealing only with contracted health care providers.

However there are 4 categories of physicians who notoriously do not enter into contracts with health insurers. They have essentially chosen to remain free agents.

If you’ve seen the political ads on television referencing “surprise billing”, these are the healthcare providers and situations typically driving those surprise bills.

Non-contracted physicians are most often:

- Radiologists (the x-ray/imaging guys)

- Anesthesiologists (the put you to sleep guys)

- Pathologists (the blood and tissue analysis guys)

- Emergency Room (ER) physician groups.

Remember: It’s important to educate yourself and know who these guys are and in what types of circumstances you’re most likely to find them. If you don’t you run the risk of falling into that 78% of people who find themselves blind-sided by medical debt despite having health insurance.

#5 – Know Where Non-Contracted Providers are Hiding

Unfortunately non-contracted physicians are mostly found in hospitals that are contracted with your insurance carrier which makes things even more confusing for consumers. Other out-patient procedures such as colonoscopies or knee surgeries can also employ healthcare providers from the above list. Here’s a typical example:

EXAMPLE:

Your 15 year old falls and breaks his arm on a Saturday night. You take him into the Emergency Room at a hospital that is contracted with your health insurer. The following plays out:

- Emergency Room (ER) Physician comes into the room and examines your child. He orders an x-ray.

- Radiologist reads the x-ray and confirms the arm is in fact broken.

- ER physician states they are going to have to put your child out while they set the fracture.

- Anesthesiologist administers anesthetic to your child so that he doesn’t feel any pain while the doctor sets the fracture.

A month later, while going through the mail, you open an invoice from the ER Physician group who saw your child that evening. It’s a bill in the amount of $500.00. The invoice shows that they billed your health insurance company $800 for that visit, however your health insurer reimbursed them using the fee schedule the insurance company uses for reimbursing contracted physicians so let’s say in this case it’s $300 (also called the “allowed amount”). The ER physician group is looking to you for the difference ($500) also called a “balance bill” because you’re being billed for the “balance”.

This scenario plays out with all of the other providers involved in your child’s care that evening as follows*:

Radiologist

Bills your health insurer: $1,500

Health insurer pays: $600

You owe (the balance bill): $900

Anesthesiologist

Bills your health insurer: $3,000

Health insurer pays: $1,000

You owe (the balance bill): $2,000

Last week a woman came to me after an employee meeting and thanked me for saving her $900 last year when she visited the ER with her son. She had asked the staff that night if the ER doctor on call was contracted with her insurance company. She remembered the magic word is “contracted”. When they told her he was not she remembered what I had taught her and demanded to see a physician who was contracted with her insurance company. They found her one – quickly.

Remember: In emergency situations, demand to be treated by “contracted” providers. In elective procedures like colonoscopies do the same, and confirm with each physician involved in the procedure ahead of time and in writing that they will all be willing to accept your health insurer’s contracted rate as payment in full.

Be Your Own Best Advocate

No one is as motivated to help you avoid medical debt as you are. Except maybe me. Being a savvy consumer of healthcare is not for the faint of heart, but it is well worth learning how to keep your head above water and the wolves away from the door.

Empower your employees with the education and tips they need each year to stay ahead of the curve by giving them access to the experts who can help. As the employer it costs you nothing, but it may be one of the most valuable things you ever give them.

*These amounts are examples only and are not reflective of actual costs.