Arizona Health Insurance in 2017 – Surviving the Meltdown

As of yesterday, November 1st, Americans looking to buy health insurance embarked on another Federal open enrollment period. By now it is no secret that the individual health insurance market in Arizona is a mess. So much so that the Wall Street Journal dedicated an entire article to us earlier this week. You can read it here or you can read my simplified version in this article.

The Bad News:

Insurance companies have made drastic changes to the standard 4 “P”s that drive a company’s marketing strategy – price, product, place and promotion.

Price: Premiums have gone up

Products: Products are limited

Place: Only certain products are available in certain counties

Promotion: Insurance companies are no longer promoting their individual product lines. To ensure no one else is promoting them either, most have stopped compensating brokers who traditionally specialized in individual policies.

The Good News:

I, along with a number of industry executives, believe that our current situation in Arizona and across the country is temporary. Regardless of the outcome following the election, everyone recognizes that we have reached a breaking point and that significant changes to health insurance are necessary to move forward in a direction that is in the best interest of consumers.

Until then, here is a brief explanation of what’s going on, along with a simplified buyer’s guide that will help Arizonans understand their health insurance options.

Why Is Health Insurance So Expensive?

Whether it’s home, auto, travel or health, insurance companies are in the business of risk. For a price, they will take on risk that you don’t want. When it comes to managing risk, it is widely known that there are only 4 choices that apply – either you can accept it, avoid it, manage it or transfer it.

Here’s an example. Let’s say your friends invite you to go bungee jumping. If you:

Accept the Risk: You agree to join your friends and accept all of the risks that come with the activity.

Avoid the Risk: You eliminate any risks involved by deciding against participating all together.

Manage the Risk: You decide you will join your friends in the activity but not before enrolling in the safety course, and purchasing safety equipment such as helmet, harness, etc.

Transfer the Risk: You go out and buy an insurance policy so that in the event you are injured or disabled as a result of participating, you’re protected.

Insurance companies all over the world use the exact same tactics when assessing and pricing for risk.

How Did Insurers Keep Their Costs Down Before the Affordable Care Act (ACA)?

Avoiding Risk Before the ACA:

Prior to the ACA health insurers avoided certain risks by refusing to sell coverage to individuals who presented a significant health risk. While this helped keep health insurance premiums down, it presented a problem for people who had major health issues that required medical attention. Either those individuals had to accept crippling medical debt as part of their reality, or avoid seeking costly medical attention that could dramatically improve their quality of life or even save it.

What Changed?

In January, 2014, the Affordable Care Act outlawed the practice of insurance companies refusing coverage to sick people in an effort to make sure those who needed it could buy health insurance. This created an influx of new customers for the insurance companies, which normally would be a good thing for all of us except they were customers who had an immediate need for services, such as costly surgeries and therapies, diagnostic testing, outpatient procedures, expensive prescription medications, etc.

In order for insurance companies to absorb these new customers with little or no affect to premiums they also needed a greater number of healthy customers to purchase coverage who DIDN’T have an immediate need for health care. While the government made it a rule that all Americans had to buy health insurance or pay a penalty, the penalty wasn’t enough to incent people to go buy insurance. As a result the insurance company didn’t get the right mix of customers it needed to absorb the cost of the bad health risk it’s been taking on over the last 3 years.

Managing Risk Before the ACA:

Prior to the ACA health insurers were able to price insurance policies based on the health risk you posed. Age didn’t matter as much as whether or not you were healthy. So a 45 year old female smoker on high blood pressure medication would pay more than a 60 year old non-smoker male with a clean bill of health. This ensured that insurance companies were able to collect enough premium to pay claims.

What Changed?

The ACA outlawed the rating formula based on health status and required insurers to adopt a rating formula based strictly on age. As a result, beginning in January, 2014, the older you are the more you will pay regardless of your health status. So a 25 year old with a serious, chronic health condition such as leukemia or a teenager with a congenital heart defect will pay considerably less for her health insurance than a 50 year old adult with a clean bill of health. All insurance models require that insurers be able to price risk accurately. The ACA largely disrupted this ability, hence the market meltdown.

How Are Insurers Keeping Their Costs Down In 2017?

Avoiding the Risk

For 2017, many health insurers have decided to just avoid risk altogether and pulled or drastically altered their individual product lines, particularly in the heaviest populated regions of Arizona like Maricopa County.

Managing the Risk

Arizona carriers selling individual policies have added new features and cost-control mechanisms such as:

- Limiting the network of physicians available to you

- Requiring referrals to specialists to be made by your family physician versus you being able to make the appointment yourself

- Limiting their exposure to risk through inexpensive “Catastrophic” policies typically limited to individuals between the ages of 0-29 years of age

- Offering Short Term Medical policies that are good for a period of less than one year, some available to children only.

What Is the Best Option for People In Maricopa County?

For the first time ever, Blue Cross Blue Shield of Arizona (BCBSAZ) will not be selling individual health insurance products in Maricopa County. The best option for individuals in Maricopa County is going to be the Health Net product “Ambetter”, an individual policy product. Unlike the majority of other individual policies available, you do NOT need to choose a Primary Care Provider (PCP) or obtain referrals to see a specialist. In addition, pretty much every hospital, with the exception of Mayo and Banner are in the network.

What Are the Best Options for People Throughout Arizona?

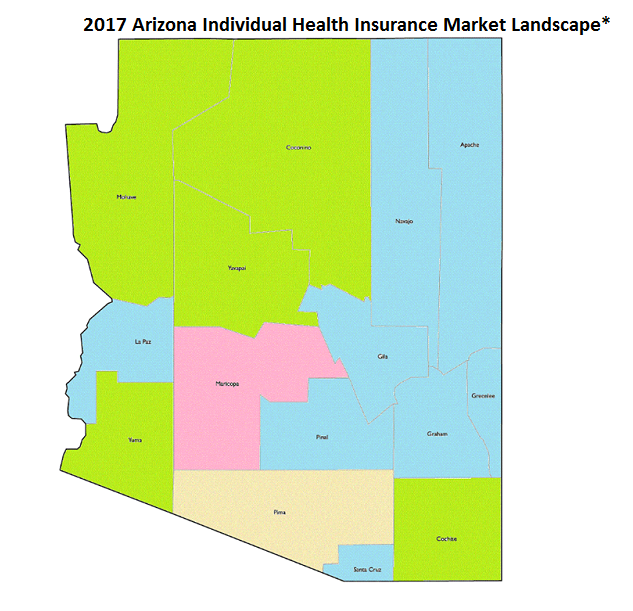

For an overview of the Arizona health insurance market by county, refer to the map below along with descriptions of the various plans available in each region.

- BCBSAZ will be selling Gold, Silver, Bronze and Catastrophic plans. Available for purchase at www.healthcare.gov

- BCBSAZ will be selling Gold, Silver, Bronze and Catastrophic plans. Available for purchase at www.healthcare.gov

- BCBSAZ will be selling Catastrophic plans only at www.healthcare.gov

- Health Net will be selling Gold and Silver plans, available for purchase direct from Health Net at www.healthnet.com or at www.healthcare.gov

-

BCBSAZ will NOT be selling individual/family policies to anyone.

-

Health Net will be selling its Ambetter individual policies – Gold, Silver and Bronze. Available for purchase direct from Health Net at www.healthnet.com or at www.healthcare.gov

-

Aetna will be selling a Silver policy available for purchase direct from Aetna.

-

Cigna will be selling a Bronze policy available for purchase direct from Cigna at www.Cigna.com

* This information is based on information provided by the Arizona Department of Insurance (DOI) and the carriers based on their 2017 filings with the AZ DOI. The above information can change at any time.