ACA Reporting – 3 Tips To Help You Prepare

As I write this article there are 75 days left until Christmas and 81 days left for employers to organize and finalize the health insurance information they will have to report to the IRS in 2017.

The following are examples of some fairly straight forward questions for which, by now, most employers know the answers:

- Which Affordable Care Act (ACA) reporting requirements apply to you?

- Which forms are you required to use?

- Which of your employees, past or present is required to receive a form?

- What is the deadline for providing a copy of the form to past or present employees?

- What are the deadlines for reporting to the IRS?

- What format must you use to submit the forms to the IRS?

However, the most difficult question and the one that remains most troublesome for employers in terms of incurring penalties is:

What information must be entered on the forms?

Beginning in 2017 the IRS will enforce penalties for errors in reporting. The penalty for failure to file a correct information return is $260 for each return for which the failure occurs, with the total penalty for a calendar year not to exceed $3,193,000. To be ready in time for January you need to have been tracking and recording the following information for all of the previous tax year:

- Every person you hired – full time, part-time, variable hour and seasonal employees

- If/when they became a full time employee

- If/when they terminated their employment

- When they were offered health insurance

- What, if any, waiting periods were applied

- What type of health insurance you offered

- What you charged for it

- Which of the affordability safe harbors you are using

- Whether the employee accepted health insurance once it was offered

- If the employee accepted, did he/she enroll any other family members at any time

- If so, what are the dates of birth and social security numbers

- How long did the employee stay on the health insurance plan? How about his family members?

- If he didn’t accept the offer of health insurance, did you record the waiver of coverage?

- And remember, whatever you’re reporting on the forms – such as how you determine full time employees, your measurement periods, whether or not you offer to spouses or not, better be documented somewhere in case of audit.

Who has the hardest time with ACA reporting?

The burden of reporting is greatest for those employers when any of the following factors are present:

- You had a high staff turnover the previous tax year.

- You are doing payroll in house.

- You produce your forms manually.

- You lack an online administration system that is tracking and recording the offer of health insurance to all full time employees.

- Your payroll software doesn’t support ACA reporting requirements.

- You lack a reporting expert within the company who understands the various codes used to report the complex aspects of the employers offer of health coverage along with IRS audit focal points.

How do I avoid the ACA reporting chaos in 2017?

Each year the IRS is going to ask you for your payroll and benefits data for the previous year in order to determine whether the indicator codes you have used to populate your forms are accurate.

One wrong code populated on 200 forms will cost you $260 per form in 2017. That totals $65,000 and assumes only one error per form.

I cannot stress enough the importance of getting on top of this obligation NOW. Preparing for annual reporting is not something to start a week before it is due. If you haven’t started, don’t know where to start, or want to improve upon what you did last year, reach out to your payroll vendor or a benefit consulting firm like mine that specializes in health insurance and is educated in the complexities of the reporting requirements. Whatever you do – do it now. I guarantee the cost is going to be incremental when compared to the cost of potential fines charged for mistakes.

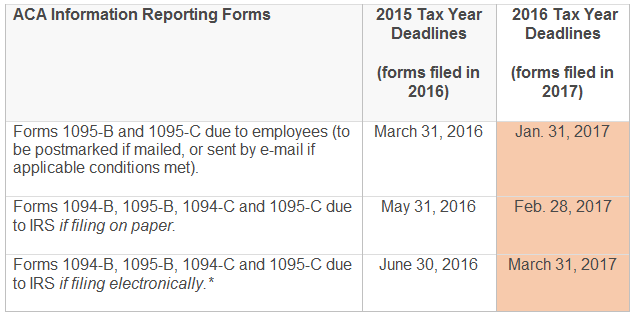

Below is a table that shows the new deadlines for the ACA reporting.

Summary

You wouldn’t attempt to complete and produce your W2s manually. The 1094/95 C reporting is no different, and in fact, is more complicated because of all the factors listed earlier in this article.

This is the second year our firm has assisted clients with fulfilling their reporting obligations. We will take new reporting clients from now until December 31st. If you simply have questions about the requirements or this article in particular please call me at 602-903-4047.

Last year employers scrambling at the last minute had a hard time finding firms that were taking new reporting clients, and if they did, those firms charged a significant amount of money for their services because, well, they could. If you’re printing forms and distributing manually then January 20th is roughly when they need to go to the printer in order to get mailed by January 31st.

When it comes to ACA reporting and avoiding penalties the Boy Scout motto applies – be prepared!