3 Employer Strategies for Saving Big on Health Insurance

In Arizona, between 80-85% of an employer’s health insurance premium is used by the insurer to pay claims. Companies looking to make a serious dent in health insurance costs need to focus on solutions that help reduce the insurer’s claim spend.

Here are the 3 areas that have the greatest influence when it comes to claim costs and the most effective strategies Arizona employers are adopting to address each of them.

1. How Claims Are Financed

Self-Funding

Self-funding is a claim financing strategy that can significantly curb a company’s overall spend on health insurance. Over the years it’s received a bad rap in the small employer market because the term “self-funding” conjures up images of owners going bankrupt when an employee is diagnosed with a chronic illness. Not the case!

The largest variable factor in a health insurance premium is the amount of money the insurer expects to pay out in claims. This is called the “Expected Claims Factor”. Every insurer bases their premiums on what they expect to pay out in claims.

EXAMPLE:

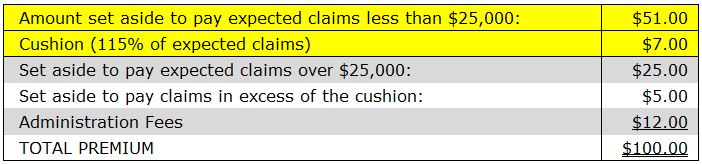

To keep things simple, let’s use a basic example of $100.00 as an employer’s total health insurance premium. Behind the scenes the insurer has that number broken down as follows:

*components illustrative only; based on example of $100.00 total premium

In a fully insured claim financing arrangement all of the above components are fixed. So even when an employer’s claims come in under what was expected there is no money returned to the employer.

However, in a self-funded arrangement the first two premium components highlighted in yellow are variable so if the employer’s claims run better than expected then a portion of the premium surplus is returned to the company. If claims run worse than expected, the other insurance components designed for protection kick in.

In recent years, partial self-funding has become an increasingly viable strategy for more and more employers and now there are self-funded products tailored specifically for smaller employers that remove any major risk so it’s definitely worth exploring.

2. How Claims Are Paid

Reference Based Pricing

The challenge for insurers looking to curb claim costs is the fact that physician and hospital billing largely differs according to who’s paying them. For example – if you’ve ever offered to pay cash for a medical service such as an office visit or MRI you will have likely received a better price than if you had used your insurance plan.

EXAMPLE:

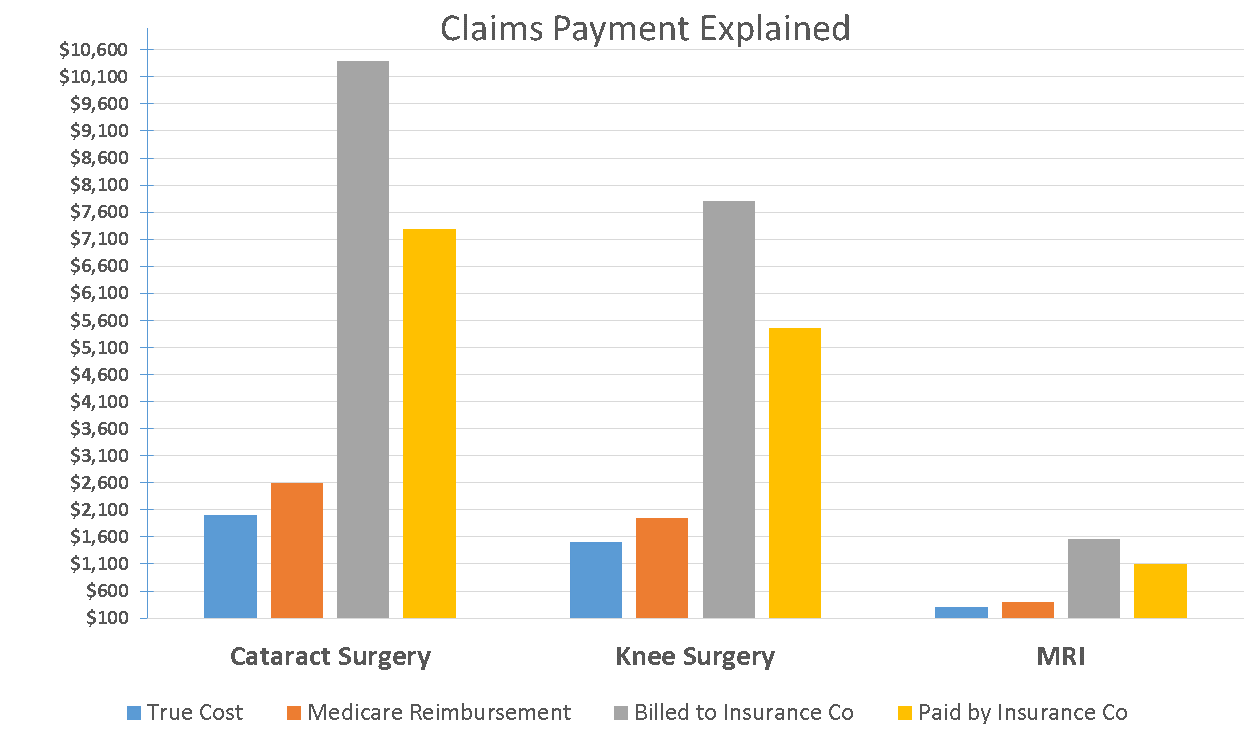

Here’s how it works. Let’s assume I’m a doctor, and my true cost for a particular medical service delivered to a patient is $100.00. Reimbursements based on payer, work as follows:

- Medicare will pay me $130.00 for that service

- However, if I bill a private insurer such as United Healthcare or Blue Cross Blue Shield, I can bill up to 400% of what Medicare would pay me

- That insurer will then discount that amount by 30%, and pay me accordingly

Looks like this:

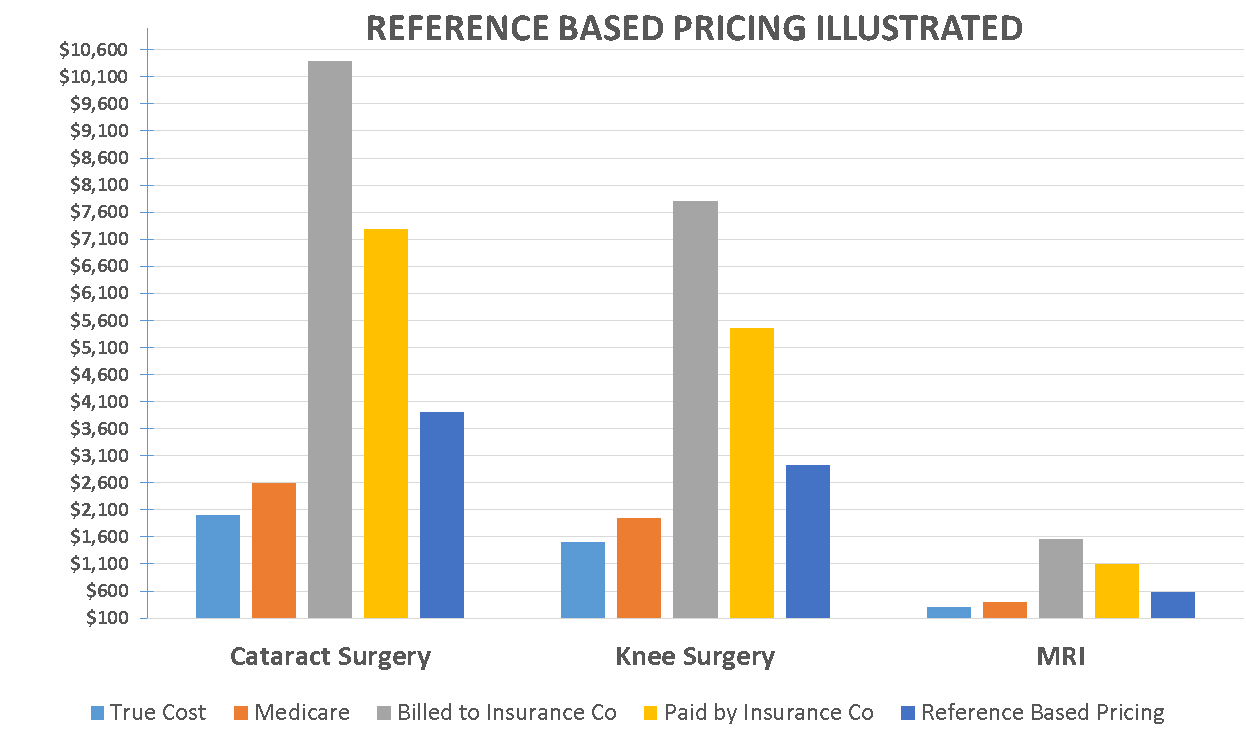

Reference-based pricing is a relatively new approach quickly gaining traction with Arizona employers . The concept abolishes the traditional PPO network model and simply:

- reimburses healthcare providers using a multiple of Medicare reimbursement rates

- allows employees to see whatever healthcare provider they wish

- pays non-hospital claims at typically 150% of what Medicare would pay for that same service

- pays hospital claims in the ballpark of 175% of what Medicare would pay

The savings to employers can be huge and everyone, particularly employees, like the idea of paying a more reasonable fee for healthcare services.

3. How Claims Are Incurred

Healthcare Bluebook™

Consumerism tactics such as Health Savings Accounts (HSAs), Telehealth, and limited networks are just some of the ways employers can steer employees toward more economical choices when it comes to health services.

These tactics in combination with additional consumerism resources like “Healthcare Bluebook™” can produce significant savings for both employers and employees.

- Healthcare Bluebook™ empowers employees to be savvy consumers of healthcare.

- When you visit Healthcare Bluebook™, type in your zip code and the name of the procedure you want to price – such as a colonoscopy or cataract surgery.

- Healthcare Bluebook™ will produce the least expensive to most expensive price you can expect to pay for that procedure in your area. It will also show you the “fair” price and list the facilities that offer that procedure ranging from most economical to most expensive.

For a quick demonstration of Healthcare Bluebook™ at work, watch this short clip:

Next time you’re considering new strategies to reduce your costs, ask yourself if you’re confident your company is doing everything it can to reduce your claims spend.

If you have questions about these topics or would like to explore Reference Based Pricing, Healthcare Bluebook or Self-funding further, call us at 602-903-4047 or email me at jmorrow@employerbenefitsandadvice.com.